Goldman Sachs increased its S&P 500 price target to match its upbeat view on company earnings even as others sound the alarm on risky stocks.

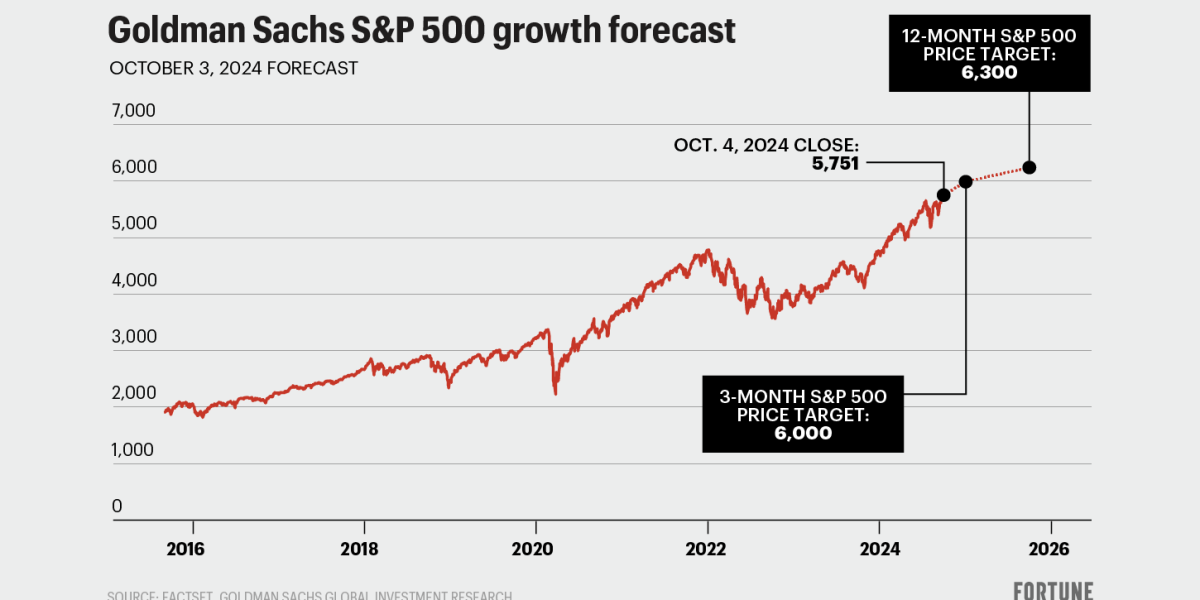

Analysts led by David Kostin wrote in a Friday note that the firm predicts the S&P 500 will reach 6,000 by the end of the year and 6,300 a year from now. If Goldman’s predictions are correct, the broad stock market index could increase by 4% through December and 10% over the next year.

The revision is up from Goldman’s earlier predictions that the S&P 500 would reach 5,600 by year’s end and 6,000 over the next 12 months.

Although the analysts acknowledged in the note that the firm’s target was slightly higher than what other experts are predicting, they argued that profit margins will rise and company earnings will be higher next year and into 2026.

Profit margins could increase to 12.3% next year and 12.6% in 2026, up from the 11.5% estimated for the end of this year, the Goldman analysts wrote. Their earnings per share estimate for the S&P 500 rose from $256 to $268, which represents an 11% increase on an annual basis.

“The macro backdrop remains conducive to modest margin expansion, with prices charged outpacing input cost growth,” the analysts wrote.

The index will benefit from the absence of major charges that especially weighed on the health care sector this year, including for companies like Bristol-Myers Squibb and Gilead Sciences. Warner Brothers Discovery also took a $9 billion write down on its TV networks, and Uber faced a $500 million charge this year that won’t be a hindrance next year, the analysts argued. Growth in the information technology sector, thanks to a recovery in semiconductors, will also help.

Goldman’s elevated price target comes as the stock market rallies, recording its best first nine months of a year since 1997, the Wall Street Journal reported. The S&P 500 is up 20% year to date.

A frenzy resulting from rosy predictions on AI’s potential has also pushed up tech stocks this year. Optimism from investors that the Fed has nearly pulled off a “soft landing” after the unemployment rate fell last month has been a boon to the stock market as well.

At the same time, not everyone is convinced that the future holds more good news. JPMorgan Asset Management’s David Kelly told Business Insider that investors should be wary about continuing to bet on risky, high-growth stocks even if things look good right now.

“I will say that although I think this is positive for the equity market, I am getting increasingly queasy about the fact that the equity market keeps on pricing in a soft landing,” he said.

Kelly recommended investors who are riding the high of this year’s stock market gains rotate their portfolio to value assets or international equities as valuations become distorted.

“They should dial back risk,” Kelly suggested. “There’s no need to increase risk if you’ve got enough money to do the things that you want to do.”