Tyme Group, a South African-born fintech operating in the African country and the Philippines, has secured $250 million in a Series D round, pushing its valuation to $1.5 billion. The funding was led by Nu Holdings (which owns NuBank), Latin America’s most valuable fintech, which invested $150 million for a 10% stake. M&G Catalyst Fund chipped in $50 million while existing shareholders provided the remaining $50 million.

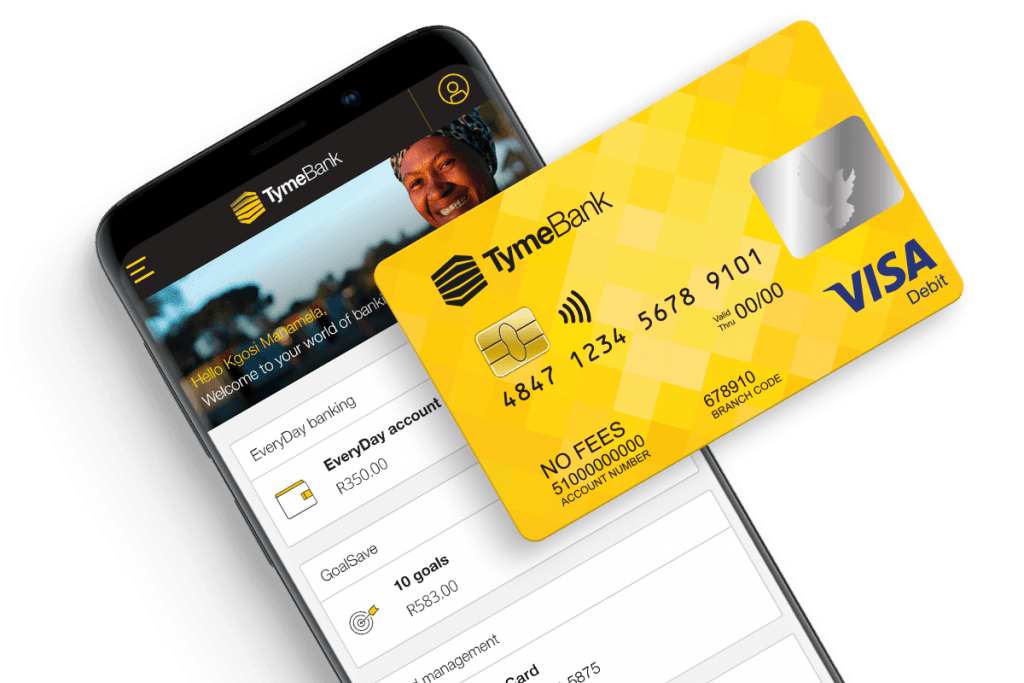

Founded in 2019, the Singapore-headquartered Tyme Group operates a hybrid digital banking model that combines online banking with physical service touchpoints.

The company, which now serves 15 million customers, focuses on building and scaling digital banks in emerging markets. Its South African brand, TymeBank, has been a key driver of its growth (10 million users). GoTyme in the Philippines—launched in 2022 in partnership with local conglomerate Gokongwei Group—marked its entry into Asia (with 5 million users). Tyme plans to expand further into Vietnam and Indonesia next year.

Tyme remains majority-owned by Patrice Motsepe’s African Rainbow Capital (ARC), which retains a 40% stake in the fintech. Last year, the fintech raised $77.8 million in a pre-Series C round, backed by Tencent, Blue Earth Capital, and Norrsken22.

The latest funding, which takes Tyme’s total raise to over $400 million, marks a notable recovery in investor interest in fintechs after a slowdown caused by rising global interest rates. Tyme joins Nigeria’s Moniepoint as one of the African fintechs to achieve unicorn status this year.

Clearly, Nubank’s investment in Tyme Group aligns with its broader strategy to diversify geographically and tap into the growth potential of emerging markets outside Latin America, albeit not organically.

While the largest digital banking platform has cemented itself as a dominant player in Brazil, Mexico, and Colombia, with over 100 million customers, its core markets are becoming increasingly competitive, with the likes of Neon and C6 vying for customers.

Expanding, via investments, into Asia and Africa—regions where digital financial services are still underpenetrated—offers Nubank a chance to replicate its playbook in markets with similar dynamics: large unbanked populations, growing smartphone adoption, and rising demand for accessible financial products.

“Since the beginning of Nubank, we have believed that the future of financial services globally is of digitally-native companies. We have met dozens of teams across different geographies, and we think that Tyme Group is extremely well-positioned to be one of the digital bank leaders in Africa and South East Asia. We are excited to work with Tyme to share many of our learnings of scaling this model to hundreds of millions of customers,” says David Vélez, founder and CEO of Nubank.

Tyme isn’t Nubank’s first move outside its home turf, though. In 2021, the Brazilian fintech invested in the Indian neobank Jupiter.

Tyme, which offers checking and savings accounts with debit cards and credit via buy now, pay later, claims to have raised over $400 million in customer deposits and extended more than $600 million in finance to small businesses across South Africa and the Phillippines.