Global food production generates at least a quarter of greenhouse gas emissions, more than 80% of which comes from agriculture. But addressing that impact is easier said than done since there are simply so many moving parts to address.

“Regenerative” farming is often touted as one way to make progress towards several sustainability goals, as it offers farmers an opportunity to reduce carbon emissions while increasing biodiversity and enriching soil. That directly impacts food production, and therefore, food supply.

Berlin-based agritech startup Klim is working to get farms to switch to regenerative farming more easily, and to help expand its operations internationally, the startup recently secured a $22 million Series A funding round led by Europe’s largest bank BNP Paribas. Notably, the round is one of the largest raised by agritech startups in Europe this year.

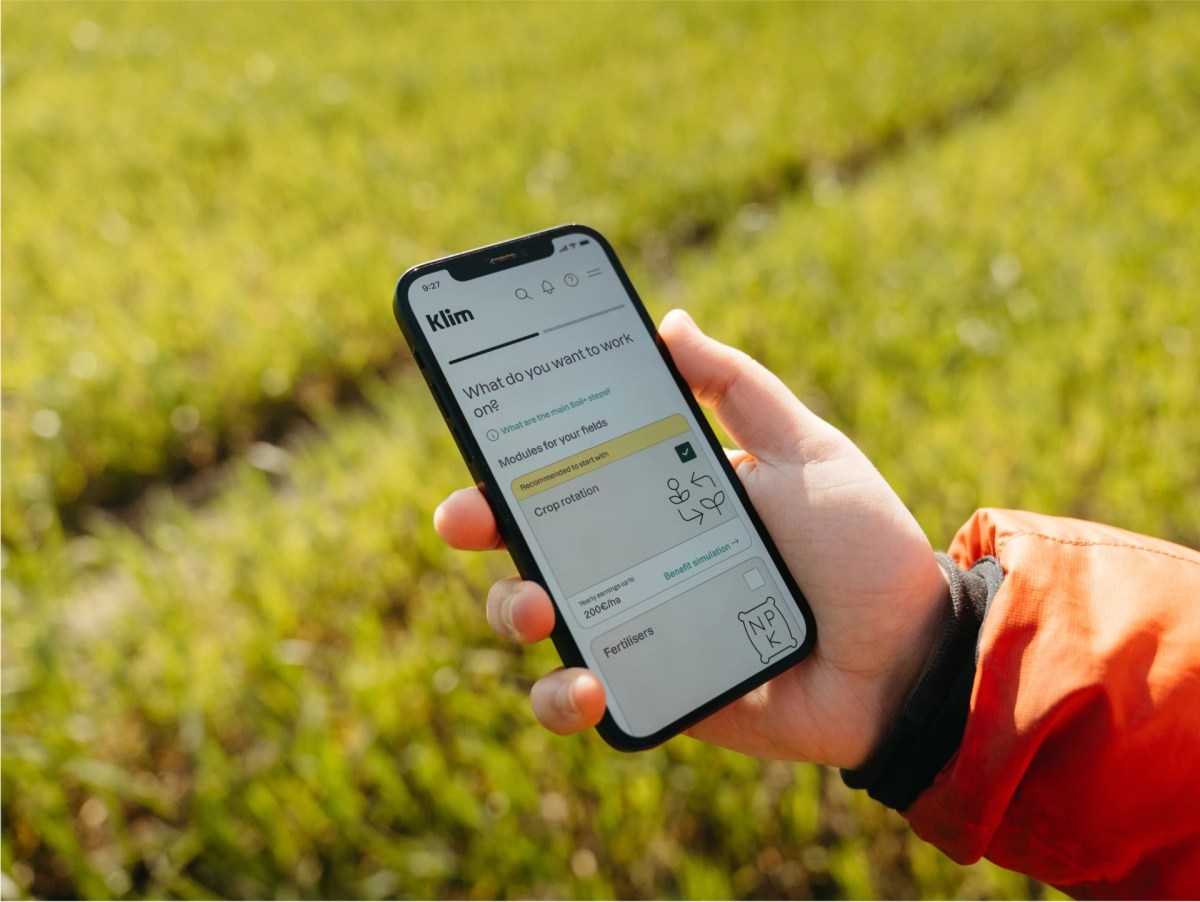

With Klim, farmers get tools to plan, execute and finance the transition to regenerative practices. This includes data on restoring soil health, biodiversity, capturing carbon and reducing emissions.

Farmers can also use Klim’s platform to track the progress of their transition and prove it to supply chain partners, enabling them to earn revenue payouts for sequestered carbon. Klim then takes a commission on the sale of carbon “insets” linked to supply chains, and farmers can generate revenue from these by selling them on Klim’s marketplace.

In turn, food companies can buy these “ecosystem services” to make their supply chains greener, especially as emissions reporting requirements increase. In other words, a farmer gets paid for “farming carbon” as much as raising and selling crops or cattle.

Klim was founded in 2020 in Berlin by Robert Gerlach, Nina Mannheimer and Adiv Maimon, and in the past four years, the startup says it has served 3,500 farmers, which equates to 700,000 hectares of land, representing 5% of German farmland. Its clients now include agriculture giants like Nestlé, Kaufland and Aryzta.

Speaking to TechCrunch, Gerlach (CEO) said that given the world is gradually losing more soil, and many global soils have already lost 50% of their original organic carbon stock, “there’s a real urgency to transition farmland to regenerative practices.”

“You need to do two things to get a farmer to regenerative agriculture. The first is a digital agronomist that shows them how to best start for their particular farm’s context. This includes how to minimize the risk, for example, starting with only 5% of the farm, choosing the right methods,” Gerlach said.

He said the second thing is to quantify the impact: “We do that with a mix of satellite data, soil samples, and primary data that the farmer has to put into the platform, which then all goes into a certified model. That quantifies the emission removals and reductions. But it would be a misunderstanding to say we are used for carbon offsets.”

“What companies like Nestlé really need is reliability. Supply chains are degrading, meaning harvests are less predictable. This is really problematic for the food companies,” he added.

The new funding will be used to expand the company’s operations outside of Germany.

Klim is not alone in this space, especially in Europe, where agritech is a well-developed sector. For instance, Agricarbon, based in Dundee, Scotland, measures and validates soil carbon capture and storage for farms and carbon markets, and it has raised over €14 million. Another competitor, Regrow, has raised $63.6 million, while Soil Capital has raised €5 million.

“Klim’s innovative platform and approach to scaling regenerative agriculture are perfectly aligned with our commitment to financing solutions that mitigate climate change, make the ecosystems more resilient and improve people’s livelihoods,” Maha Keramane, head of BNP Paribas’ Positive Impact Business Accelerator, said in a statement.

Klim’s Series A round also saw participation from Earthshot Ventures, Rabobank, Agfunder, Norinchukin Bank, Achmea, Ananda Impact Ventures, and Elevator Ventures — the VC arm of Raiffeisenbank International. In 2022, the startup closed a $6.6 million seed round that was led by Berlin-based food and green tech investor, Green Generation Fund.