Following a report that E*Trade may kick meme stock guru Roaring Kitty off its platform, some of his fans have questioned whether his supposed market manipulation isn’t exactly what politicians and Wall Street traders do daily.

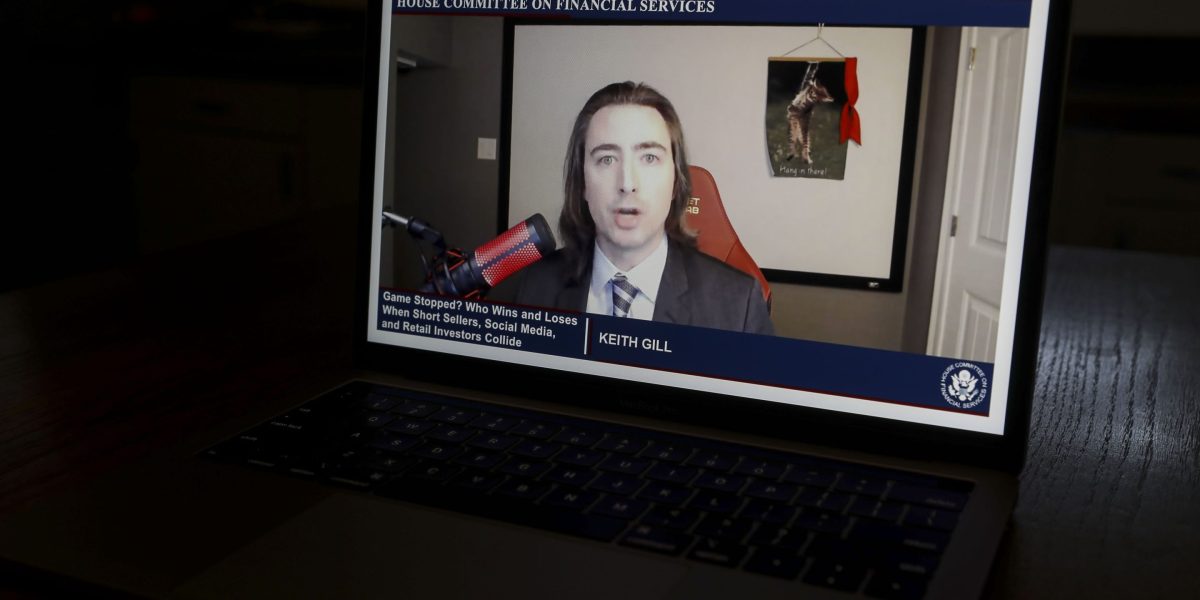

Top leaders at the Morgan Stanley-owned brokerage are concerned that Roaring Kitty, whose real name is Keith Gill, has outsized online influence that could lead him to manipulate stocks for his own benefit, the Wall Street Journal reported, citing people familiar with the matter. Those weighing the decision at E*Trade and Morgan Stanley were particularly worried about a large sum of options Gill bought just before he helped bring the GameStock trade back to life with his first social media post in years last month. Now, this week, a screenshot of Gill’s brokerage account showed that he had $260 million in play on the stock.

Since he returned to social media last month after a three-year hiatus, Gill has issued a series of cryptic posts on X. His posts are mostly memes, and few mention GameStop directly. The company’s shares are up 56% since the last trading day before Gill returned to social media.

The report that Gill may get banned from E*Trade has revived an anti-establishment uproar that first fueled the meme-stock frenzy in 2021 as highlighted in the film Dumb Money. At the time, retail traders attacked hedge funds like Ken Griffin’s $62 billion Citadel and the now-defunct Melvin Capital, accusing them of rigging the game.

Although it’s unclear whether E*Trade will actually ban Gill or drop the issue, some of the retail investor’s fans have said what he is doing is no different than what Wall Street bigwigs do regularly.

“How is going on national television to shit on a stock, or tell people what to buy not market manipulation but this is,” wrote one Reddit fan who goes by the name CedgeDC.

Wall Street traders and other pundits often appear on TV to talk about public companies. Short sellers, especially, are known to wage public campaigns against stocks that they are shorting.

Some on social media also pointed out that politicians trade stocks often, even for companies influenced directly by their legislative committees, without breaking the law.

E*Trade, owned by Morgan Stanley, is considering banning Keith Gill, known as Roaring Kitty or DeepFuckingValue, from its platform due to concerns of potential stock manipulation related to his recent purchases of GameStop options.

So… politicians can trade using insider…

— Capital (@CapStonkHQ) June 3, 2024

Gill owned about $140 million worth of GameStop shares as of a Monday update on Reddit, where he goes by the alias Deep F——Value. The Securities and Exchange Commission is also reportedly taking a look at options trades made around the time of Gill’s tweets, the Journal reported, although it’s unclear whether they are investigating Gill directly.

A spokesperson for E*Trade declined to comment on whether it was considering kicking Gill off the platform. A spokesperson for the SEC said it does not comment on the existence or nonexistence of a possible investigation. Gill did not immediately return a direct message on Reddit.

While E*Trade looks into whether to ban Gill, it is also weighing whether the move could spur an exodus of users from the platform. Gill’s 1.4 million followers on X could quickly turn on the platform if he were to come out against them, some Morgan Stanley employees reasoned, according to the Journal.

The distrust in institutions held by Gill’s army of loyal retail traders means E*Trade’s hesitancy has only made him more likable to them.

“Interesting move by E*Trade. If they’re thinking about axing Roaring Kitty, it only proves he’s onto something big,” one fan posted on X.